According to Economic Times, online lending startups have seen a 20-30% jump in user acquisition costs. And guess what? We’ve seen it too. Since both banks and fintech companies aggressively chase consumers through paid media channels, costs have skyrocketed since 2017.

When looking at 2024 alone, the fintech and lending category has experienced a 15% increase from $1200 avg user acquisition cost in Q1 of 2024, up to $1380 by Q2 2024, and an estimated $1520, or 27% increase in Q4 compared to Q1 in 2024. It continues to be a steady climb upward to find those new customers!

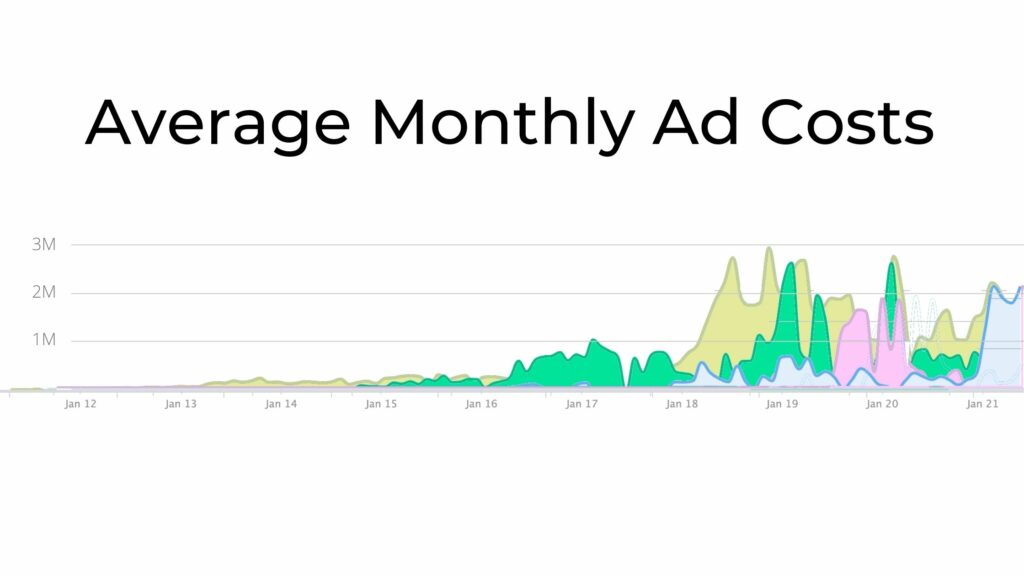

What exactly does skyrocketing mean? 800% growth in ad costs since January 2017. We tracked the largest lending companies and plotted their total spending in digital ads since 2012. Check it out:

What are the main causes for increased ad costs?

There are three major trends that affected ad budget in the sucky, not-so-friendly kind of way. Namely:

1. Everyone’s going after the same people

Long story short, everyone wants a lead with a strong debt-to-income ratio, a great credit score, a dog, a white picket fence, and a consistent payment history, who happens to be flush with cash, but want’s a new house.

So online lenders targeting prime borrowers–think Lending Club and Prosper–typically spend $350-$450 to acquire each customer. If you want to compete with that, you’ll need to spend heavy, as well.

Crunchy Links is able to get customer leads down to 36% below industry average. Ask us how.

2. High-quality leads need tighter targeting, which is more expensive

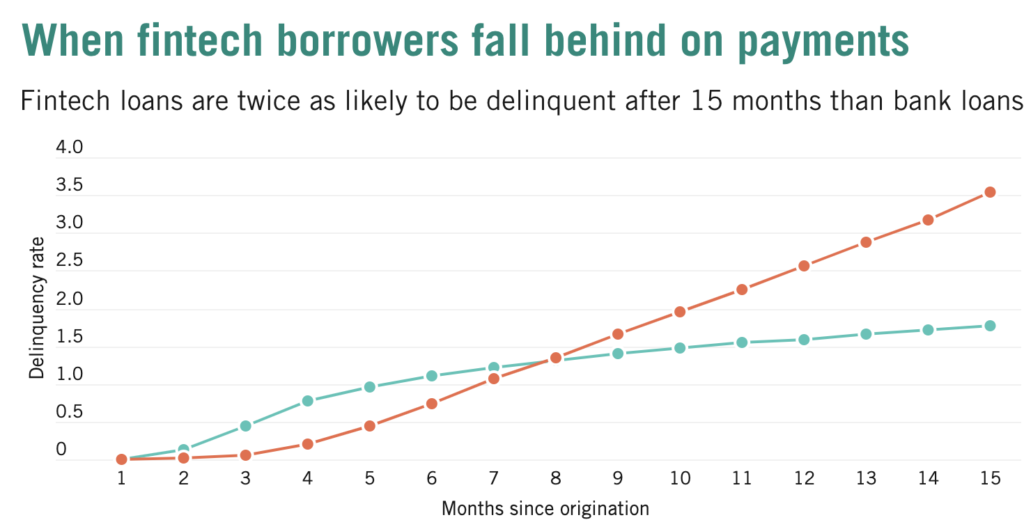

Loans for sub-prime and near-prime credit scores are in incredibly high demand. 1.3 million people a month search for these types of loans in the U.S. alone. But, those credit score categories aren’t the most sought after. They’re more likely to fall behind on payments, or default on their loan completely.

So, if you want to avoid that risk, and all the costs associated with lost revenues from defaulted loans, you’ll need to get extremely granular with your targeting. The problem? Facebook and Google limit how specific you can be when targeting potential customers. Demographic, income, and salary data are no longer available to ad buyers in the financial space. That means if you want to be more targeted, you’re going to end up paying more per click.

3. New players in the space means more competition

Fintech lending’s popularity basically exploded in the years following the financial crisis. Top brands originated $3.79 billion in loans in 2017. That’s 8x what they did in 2013. Why? Fintech companies are more agile and tend to offer a muuuuuuuuch better experience than traditional lenders. And – fun fact – they can take advantage of being subject to less regulatory scrutiny.

So, add great user experience with less regulation, and a metric ton of funding pumped into the industry, and you have a lot of fintech lenders looking to burn cash and scale quickly. What’s the fastest way to do that? Digital ads.

And, when more are in the game, the demand goes up, and bidding wars commence. Fun, right?

How can lenders and fintech companies avoid high-cost leads?

Two words. Affiliate marketing. Here’s a quick primer: Other people have websites that generate a ton of traffic. That traffic is full of people who you want to apply for a loan on your platform. You pay the website owner only after someone’s applied to your program. No need to calculate cost per click. It’s all performance-based.

Costs of an affiliate marketing program for fintech companies

Most affiliate programs in the financial industry tend to range anywhere from $50 – $150 per lead. The fun thing about an affiliate program is you can incentivize affiliates to send you higher quality leads. One home lending company pays $25 per lead and an additional $150 if it passes underwriting. When compared to $250 – $300 fintech companies pay per click (let alone the $350-$400 per lead), affiliate marketing becomes a no-brainer.

Now, if you couple affiliate marketing with creating lookalike audiences in your digital ad strategy, you’ll have a high-performing, super-targeted digital marketing campaign that’ll make money hand-over-fist. In fact, lookalike audiences can improve your ROI by up to 170% on their own.

Lookalike audiences will save you time and money

Lookalike audiences are an ideal way to help your ads reach new people who are likely to be interested in your business.

So if you create a lookalike audience based on a list of qualified leads, Facebook (and other social media platforms) can find people with similar demographics and interests to those of your existing customers. It’s a great way for fintech marketing teams to get around the limited demographic targeting they have to deal with.

Lookalike audiences can be wildly successful. Because the audience you’re showing ads to are just like those that became customers, the odds are engagement and sales will vastly outperform static ads. In fact, you can see up to 170% growth in sales when using lookalike audiences (coupled with some other wand-waving magical PPC strategies).

If you combine lookalike audience targeting with affiliate marketing, you have a one-two marketing punch that won’t break the bank, while providing you with higher quality leads and sales. If you want to know how to take advantage of this strategy, just hit us up.